Struggling with money as a student is a common thing, right? However, a number of students say finances can take over their lives, forcing them to skip lunches or even enter the sex industry for money, new data reveals.

According to the seventh annual National Student Money Survey, the student life might not be as simple as others think.

The UK-wide survey of 3,161 students reveals what lies ahead for students starting or returning to university this month.

Data shows that 59 per cent of students thought about dropping out, 36 per cent saying the stress of keeping up with the finances is the main reason.

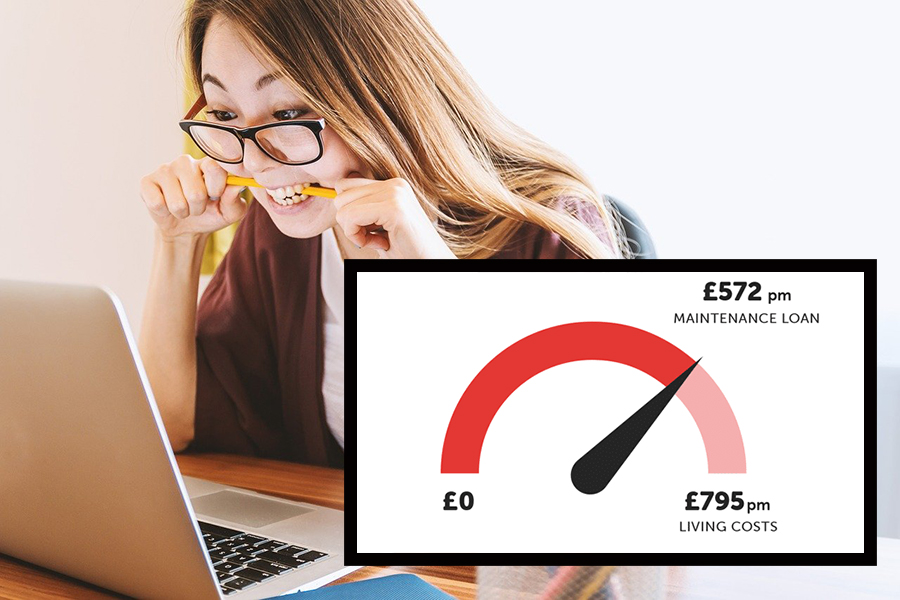

While the UK average living costs is £795 per month, the average monthly Maintenance Loan gap is £223, leaving most students rely on part-time work.

Only four per cent said they have done sex work and one in ten would turn to sex work in a cash emergency. Among students who have done sex work, the most popular forms are selling intimate photos (32%), sugar dating (24%) and OnlyFans (22%).

We asked NTU students how does money affect their life at university.

Tia Sanders, a final year Journalism student, said: “Money definitely has a big impact on my mental health.

“I live in a private rented flat and have since I first moved to university, so the majority of my loan goes on rent and bills.”

But UK students’ financial struggle doesn’t stop here as COVID-19 is causing a huge amount of financial uncertainty for young people, figures show.

Including herself in the 74 per cent majority of students who work part-time to support their living, Tia added: “I got a job last May to help me out a bit more, but this summer has been awful money wise.

“My student loan ran out and my furlough wasn’t the same as I’d usually earn over summer so I’ve been really struggling and am deep in my overdraft.

“Hopefully once my student loan comes in and I’m back at work things will change.”

Tia wouldn’t describe herself as an “excessive spender”, saying that “money issues are beyond my control”.

She added: “I think the best thing you can do is be smart with whatever money you’ve got, and if there’s an opportunity to save money or make a bit extra then take it.”

Jake Butler, Save the Student’s money expert, described the results of the study as an “an incredibly sobering revelation”.

He said: “Students are heavily reliant on income from part-time jobs and their parents to get by, because Maintenance Loans do not reflect the true costs of student living.

“With these vital top-up sources at increasing risk due to the COVID-19 pandemic, thousands of students this year may have little choice but to drop out of university or turn to alternative ways of earning money such as sex work.

“It’s more important than ever for students and parents to be aware of the financial pressures from the outset, so they can plan and budget effectively.”

Sara Khan from the National Union of Students added: “Students shouldn’t have to worry about working to cover basic necessities and should be able to focus on enjoying and thriving in their studies.

“Education is a right that students should access freely from cradle to grave, especially considering that without an education one cannot find suitable employment, and the cycle of poverty perpetuates itself.

“The UK government must therefore fund maintenance grants for students in place of the profit driven student loan system, and fully fund our education.”

By Olimpia Zagnat

Featured image: Pixabay (modified).

As well as our website, Platform has a Facebook page and a Twitter feed.

For updates on what is going on from within the campus, there’s also a Facebook group. A service that allows you access to news from both us and fellow students.